-

20 07 2021

20 07 2021Moving and handling in health and social care: Moving and

Introduce equipment only after assessment and use in accordance with the care plan and manufacturer's instructions. Moving and handling equipment used for health and social care may be classified as medical devices. The supply and design of such devices or equipment is regulated by the Medicines and Healthcare Products Regulatory Agency (MHRA).

Get Price -

20 07 2021

20 07 2021VAT rules on the sale of assets - The Friendly Accountants

Unfortunately VAT is still chargeable on the sale, as the FRS percentage would have allowed for the input VAT deduction previously. In other words, as VAT input recovery was not blocked, the sale proceeds are not VAT exempt (see cars above) For more useful information, check out our Ebooks here. And if you'd like to know how we can help you

Get Price -

20 07 2021

20 07 2021Depreciating assets and CGT | Australian Taxation Office

Depreciating assets and CGT A capital gain or capital loss from the disposal of a depreciating asset will only arise to the extent that you have used the asset for a non-taxable purpose (for example, used for private purposes). You calculate a capital gain or capital

Get Price -

20 07 2021

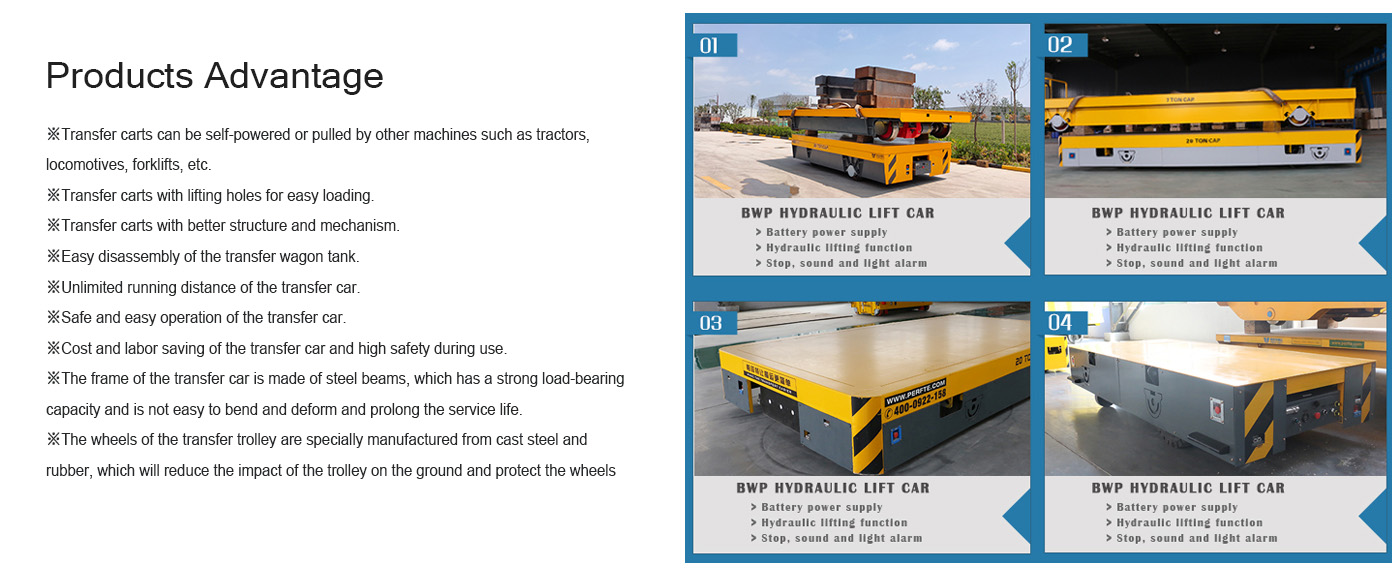

20 07 2021rail transfer car for industrial product handling 50 ton

battery platform transfer car quotation 50 tons-Perfect China Rail Transfer Car Suppliers & Manufacturers & There are two specifications for low-voltage rail carts. One is suitabl Email : market@perfte.com +86 19337383023 Home Products INDUSTRAIL TRAILER

Get Price -

20 07 2021

20 07 2021IAS 16 Property, Plant and Equipment - summary - CPDbox

6/10/2012 · Standard IAS 16 prescribes the accounting treatment for property, plant and equipment and therefore it is one of the most important and commonly applied standards. The main issues dealt in IAS 16 are recognition of property, plant and equipment, measurement at and after recognition, impairment of property, plant and equipment (although IAS 36 deals with impairment in more detail) and

Get Price -

20 07 2021

20 07 2021Waste: import and export - GOV.UK

13/3/2014 · Activity 1 shipment 2 to 5 shipments 6 to 20 shipments 21 to 100 shipments 101 to 500 shipments 501 or more shipments Export for recovery £1,450

Get Price -

20 07 2021

20 07 2021Tax considerations when transferring assets | UMN

17/7/2021 · There are numerous tax related aspects to consider when transferring assets. Some tax aspects are related to your yearly income, whereas other tax implications impact your overall estate. First we discuss tax basis and then delve deeper into other tax related transfer issues. Income tax basis Basis is the amount of capital in a property at acquisition recognized for tax purposes. When selling

Get Price -

20 07 2021

20 07 2021battery platform transfer car with weighing scale 1-500t

Battery Platform Transfer Car Electric Transfer Carts Electrical Trackless Transfer Cart Contact us Tel: + 86 193 3738 3023

Get Price -

20 07 2021

20 07 2021Transfer duty | Revenue NSW

Transfer duty rate. $0 to $14,000. $1.25 for every $100 (the minimum is $10) $14,001 to $30,000. $175 plus $1.50 for every $100 over $14,000. $30,001 to $80,000. $415 plus $1.75 for every $100 over $30,000. $80,001 to $300,000. $1,290 plus $3.50 for every $100 over $80,000.

Get Price -

20 07 2021

20 07 2021election to transfer assets at written down value -

Election to transfer assets at written down value. Where you transfer your sole trader or partnership business to a company, plant and machinery or other tangible fixed assets are often transferred too. Strictly, these assets have to be transferred at market value. Provided certain conditions are met, you can make an election (jointly with the

Get Price -

20 07 2021

20 07 2021IAS 16 — Property, Plant and Equipment

5/7/2017 · IAS 16 Property, Plant and Equipment requires impairment testing and, if necessary, recognition for property, plant, and equipment. An item of property, plant, or equipment shall not be carried at more than recoverable amount. Recoverable amount is the higher of an asset's fair value less costs to sell and its value in use.

Get Price -

20 07 2021

20 07 2021Buying a business | Revenue NSW

When you buy a business, the assets not liable for transfer duty include: $25,000 intellectual property. $25,000 stock-in-trade. Liable assets include: your factory, valued at $500,000. your plant and equipment, valued at $100,000, if they've been transferred with the land as part of the business. You must pay transfer duty on the value of your

Get Price -

20 07 2021

20 07 2021Calculating transfer duty on business asset transfers |

To calculate transfer duty when you enter into an agreement to transfer business assets, apply the transfer duty rates to the dutiable value of the agreement - the greater of the value of the business assets or the consideration paid. Vehicle registration duty rates apply to the value of any vehicle that may be transferred as part of the agreement.

Get Price -

20 07 2021

20 07 2021Mixing and Transporting Concrete

Mixing and Transporting Concrete 1.0 Introduction The successful placement of concrete is dependent upon careful mixing, the proper equipment, and adequate transportation. This site will define, analyze, and demonstrate the importance of each in the overall process

Get Price -

20 07 2021

20 07 2021Transfer duty - Western Australia

6/7/2021 · Transfer duty is imposed on certain transactions over property including transfers of real estate and certain business assets. The time when liability for duty arises varies depending on the type of dutiable transaction. In most cases this is the date the document

Get Price

-

INDUSTRAIL TRAILER Ackermann Steering Trailer Double Directions Tow Trailer General Trailer Heavy Duty Trailer RAIL TRANSFER TROLLEY Battery Powered Transfer Trolley Cable Powered Transfer Trolley Rail Powered Transfer Trolley TRANSFER CART ON WHEELS AGV Differential steering Transfer Cart Hydraulic Steering Trackless Vehicle Omnidirectional Mobile Trackless Vehicle

-

English

English

中文简体

中文简体